Together with Fisher International, I-Plan, and Valmet Automation, Tietoevry conducted a global market study among the tissue industry in June–October 2022.

The purpose of the study was to find new ways and areas to improve and focus on efficiency; enable cross-border thinking and end-to-end value creation through digitalization; and support a sustainable industry future.

A total of 50 respondents from 36 validated tissue producing corporations globally took part in the study, giving insight into their current situation and focus areas, but also sharing valuable information on the anticipated impacts of the current market situation and possible investments and trends.

Below is a brief overview of the findings in the survey.

Sustainability: Hand in hand with Digitalization

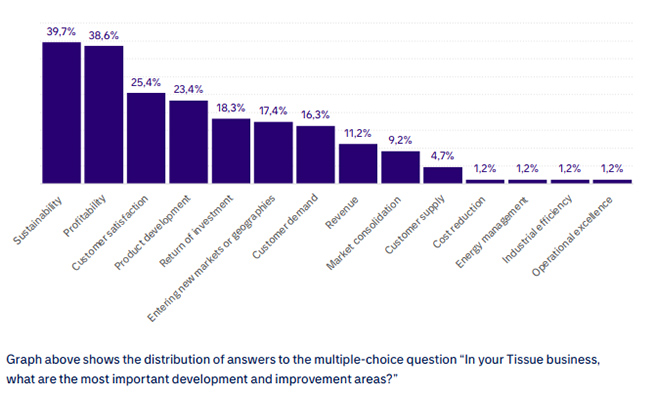

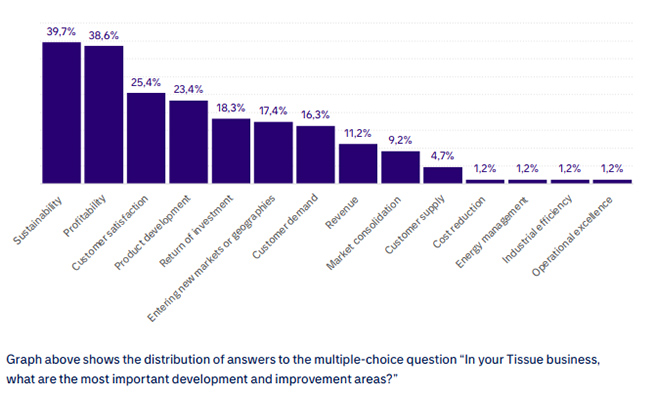

In the study, profitability and sustainability were at the top of the list when asked about important development and improvement areas. One of the key messages from the respondents is that the outlook for tissue business is uncertain in many ways and business fundamentals are being reviewed because of the volatile market situation with rising raw material costs and increasing inflation.

One of the biggest uncertainties in the industry relates to the cost and availability of raw materials. Shortages of raw materials, chemicals and spare parts have led to substantial increases in price in numerous areas and extended lead times. Increased inflation has such a dramatic and overall impact because it raises the costs of the entire supply chain, including transportation, labor, etc. At the same time, it reduces the consumer purchasing power, which puts a lot of tension on production costs and sales prices.

Thus, tissue producers are under pressure to protect their profitability and search for efficiency through sustainability and digitalization.

When it comes to digitalization in the upcoming 12 months, key focus areas are most commonly production related. A whopping 85% of respondents chose production when asked about areas where they are going to apply new technologies. 57% chose maintenance and 52% energy.

Profitability and efficiency have been at the center of discussion for several years. Next to production efficiency there is the topic of energy efficiency, and during the current European energy crisis, this has only been more pronounced. The global economy and current trends (especially in Europe) all have their effect on profitability: energy prices, raw material availability and cost are top of mind for the respondents. The tissue industry is a low-margin business where cost fluctuation has an immediate impact on profitability.

Sustainability is a new theme compared to these two; sustainability has been a globally hot topic for only the past few years – and the tissue and cardboard sectors especially have been holding more discussions around sustainability lately. While efficiency is still at the center of attention, the goal to be pursued alongside efficiency is sustainability.

Digitalization is an enabler to help improve efficiency and thus sustainability. However, no amount of digitalization or new systems will help if people and processes are not working together. People, tools, and processes are linked in a sort of “holy trinity”, where digitalization only enables more efficient working, which thus helps mills and factories to become more sustainable.

Energy Efficiency Is Top of Mind

The two most important initiatives, named by the respondents, that are planned at tissue mill sites with respect to sustainability and carbon footprint are related to energy: capital investments in equipment that can be used to reduce plant emissions and on-site investments in green energy. Thus, it is expected that companies will invest in energy efficiency in the coming years.

This is also supported by our study, which shows that the most crucial investments relate to new equipment to reduce energy in production, on-site green energy sources, and on-site power and steam generation equipment. As mentioned earlier, this study’s gap analysis also provided interesting results when it comes to efficiency. There are big gaps between the importance and current performance in energy efficiency, logistics and supply chain efficiency, and production efficiency.

As new equipment or refurbishments to reduce energy in production is the biggest investment area, there are two key processes that can be used to improve energy efficiency: pressing and drying. Energy costs are responsible for over 30% of the total costs in the tissue industry. Of that percentage, approximately 70% of the total energy consumption at tissue mills is drying energy.

Investments focused on improved pressing performance and nip dewatering means there is less water to evaporate in the drying section. Improved drying section operations (including Yankee cylinders, Yankee hoods and heat recovery) are key for maximizing energy efficient performance. Quality control systems have a significant role in the tissue making process where accurate measurements are the foundation to enable raw material and drying energy savings through reduced quality variability. All these investments are proven to lead to increased runnability of machine lines and converting lines.

So - what's next for the future of the tissue industry?

Click Below to Read the Full Report

Source: Fisher International