While the world has not permanently put the COVID pandemic in the rearview mirror, most countries have spent the last few months adapting to the impacts, reconciling damages done and assimilating to the new structural changes and habits that have formed in response to the virus.

It would be an understatement to say that massive social and economic changes continue to cascade - some expected and some unexpected - as we reach the end of 1H2021. To get a more granular view of what’s taking place in unique regions, we’ve included a snapshot of major pulp & paper industry events and announcements that have occurred in the first half of 2021 in Latin America.

Capacity

So far, the Latin American P&P sector has added a significant amount of capacity this year with plans to add more. More than 6MM tons of new market pulp is planned to come online in 2H2021 and into 2022 as many companies begin to develop new small projects, such as Papirus, in Brazil, who is planning to increase their capacity from 110,000 tons/year to 125,000 tons/year in 2022. However, the announced market pulp capacity for this year is relatively high due to some of the bigger projects that were announced, such as Klabin’s new PM27 project that will add 460,000 tons/year by 2024.

Suzano also recently-announced their plan to build a new pulp mill in the municipality of Ribas do Dio Pardo in the state of Mato Grosso do Sul. Once Suzano’s new mill, which is referred to as the Cerrado Project, is up and running, it will be the world’s largest pulp mill and will have the capacity to produce 2.3 million tons of eucalyptus pulp annually. The Cerrado Project will create a number of additional opportunities including new jobs and sustainability advancements.

Economics & Society

Throughout Latin America, the pandemic’s effects on consumer behavior triggered huge growth in the packaging business. As consumer preference shifted to e-commerce, demand and prices for corrugated boxes all over the globe increased. E-commerce in Latin America increased by 37% in 2020 and it has been estimated that 13 million people across Latin America made an online transaction for the first time in 2020. Data confirms that Brazilian corrugated cardboard increased by 13.5% in April 2021 compared to April 2020, illustrating the demand growth in this segment.

Along with this growing e-commerce trend, a growing ban on plastics has also benefited the packaging business in Latin America. In 2018, Chile was the first country in Latin America to approve a nationwide ban on single-use plastic (such as plastic bags and straws), which took effect in August 2020. Now many other countries such as Argentina, Peru, Colombia and Brazil are following suit and have enacted laws that either ban single-use plastic or, for a fee, will make it available. These restrictions have driven several companies to replace plastics in packaging, creating a huge opportunity for the paper industry.

Technology and Investments

Due to the increase in demand for packaging solutions and materials, there have been indirect signs that big pulp producers throughout Latin America could be planning investments into new segments, such as packaging. This suggests that traditional producers could be extending their footprint in the supply chain through conversions and integrations within production after different segments were impacted during the pandemic.

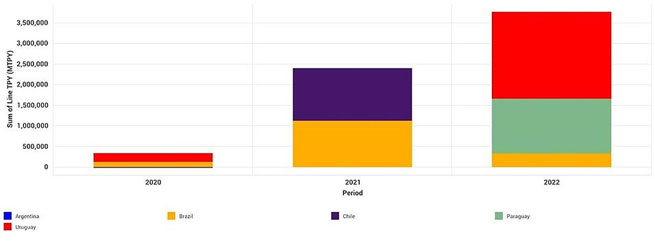

New Market Pulp Capacity Continues to Be an Engine of Growth for South America’s Industry

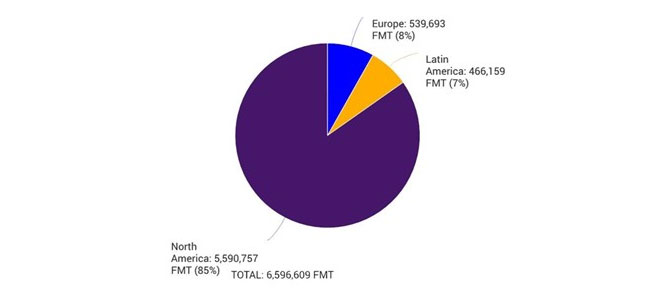

Recently, South American fluff pulp producers have been innovating within the industry. Of the 93MM tons of market pulp, about 6.5MM is fluff, and as we can see in the figure below, only a small portion of that is produced in Latin America.

Fluff Market Pulp Capacity

However, Latin American producers are also working hard to find ways to differentiate their fluff from other producers in order to stand out. Thus far, these innovations have been process related (pulping, bleaching and treatment). For example, Suzano is producing eucalyptus fluff, where 50% is eucafluff and the other 50% is softwood fluff. UPM and Arauco are using unbleached fluff with low brightness, and Stora Enso is using semi-treated and treated fluff.

Understanding developing trends in different regions is critical. And as the dust continues to settle in the wake of the pandemic, we’re beginning to get a clearer picture of the trends that are redefining the Pulp and Paper industry in the 21st century. To get a better understanding of what’s happening in your region, talk with an expert at Fisher International.

Source: Fisher International